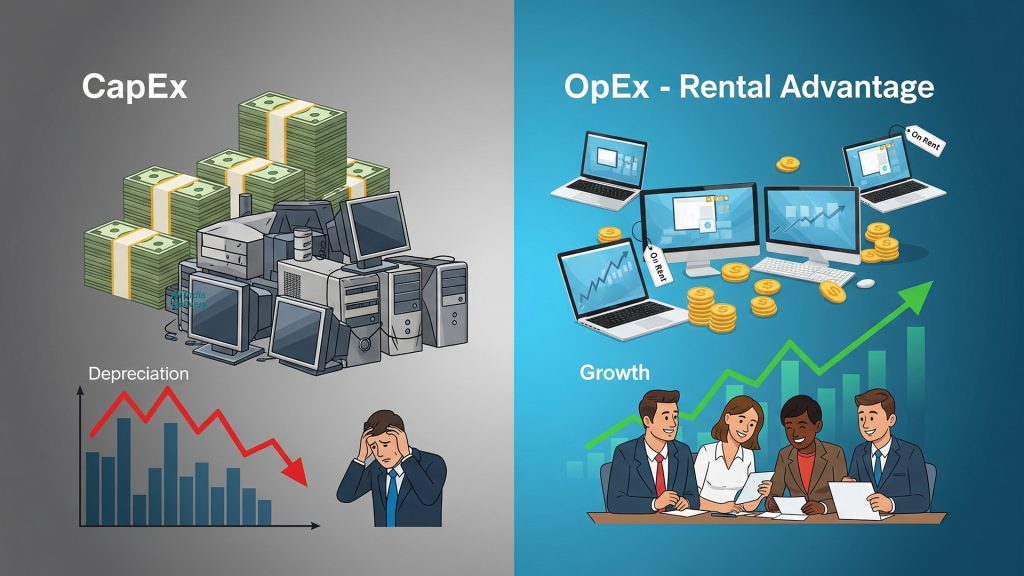

For a long time, businesses have operated on the CapEx (Capital Expenditure) model, purchasing IT assets like laptops, desktops, and servers outright. This approach offered a sense of ownership and control, but it also came with significant financial and logistical burdens. For many years, it was simply considered the cost of doing business. Companies would shell out a substantial amount of capital, deal with the complexities of depreciation, and constantly worry about their equipment becoming outdated in a rapidly evolving tech landscape. This entire cycle was a drain on both cash flow and internal resources, often leaving companies in a reactive position rather than a proactive one. Today, forward-thinking organizations are turning to the rental advantage, shifting from CapEx to OpEx to unlock flexibility, reduce risks, and ensure access to the latest technology without heavy upfront investments.

In contrast, today’s companies are discovering a far more efficient way to manage their technology needs. They are making the strategic move to an OpEx (Operational Expenditure) model by leasing IT equipment. This modern approach to asset management means you’re no longer tied down to depreciating hardware. Instead, you can distribute the cost into a predictable, manageable monthly expense. This provides a level of financial freedom and operational flexibility that simply isn’t possible with the traditional CapEx model. The Rental Advantage is clear: it allows firms to scale up or down as needed, without the hefty upfront investment.

The Capital Expenditure Conundrum

For a long time, the CapEx model was the standard, but it was fraught with challenges that often went unaddressed. The immediate impact was the immense financial pressure from a large upfront capital outlay. For a mid-sized company, this could mean millions tied up in hardware every few years. This capital, which could have been used for new product development, marketing campaigns, or talent acquisition, was instead locked into rapidly depreciating assets. Furthermore, the administrative burden was significant. IT teams were forced to become asset managers, meticulously tracking every device, managing warranties, and dealing with end-of-life disposal. This shifted their focus away from strategic, value-adding tasks and toward mundane, operational headaches.

Beyond the immediate costs, the long-term financial picture was equally complex. Companies had to account for annual depreciation, which, as a non-cash expense, could still significantly impact their financial statements. The rapid pace of technological change meant that a state-of-the-art laptop purchased today could be considered obsolete in just two or three years. This accelerated obsolescence meant that the company’s investment was constantly losing value, creating a cycle of costly replacements and upgrades. Consequently, the CapEx model often led to unpredictable and escalating maintenance and repair costs, as older hardware began to fail, leading to unplanned downtime and a further drain on resources. For any business, this unpredictability made financial forecasting a nightmare.

The Strategic Shift to OpEx

Recognizing these persistent challenges, companies are now embracing a different philosophy. The shift to an OpEx model is fundamentally a change in perspective—moving from an ownership-based mindset to a service-based one. This is not just a financial decision; it’s a strategic one that redefines how a company acquires and manages its IT infrastructure. By partnering with a rental provider, businesses can free themselves from the cyclical burden of asset ownership and focus on their core competencies. This allows them to allocate resources more efficiently and respond to market changes with greater agility.

Making the transition is often easier than it seems. It starts with an assessment of current hardware needs and a clear understanding of the financial and operational benefits. Instead of a single, massive purchase, the company enters into a flexible leasing agreement. This simple change allows for predictable financial planning and the ability to access the latest technology without the significant initial investment. The result is a more agile, resilient, and financially healthy organization. This shift also re-empowers IT teams, allowing them to move from being reactive problem-solvers to proactive innovators who can leverage the latest tech to drive business forward.

The Rental Advantage in Action: The TechNova Solutions Case Study

TechNova Solutions, a bustling software company with 250 employees, provides a perfect example of this successful transition. Historically, they operated under the CapEx model, spending over ₹30–40 lakh every 3–4 years to refresh their IT fleet. This created a persistent cash flow issue and a never-ending cycle of problems. Their books took a beating with a yearly depreciation of approximately ₹6–7 lakh, and their IT staff was tied up with managing assets instead of innovating. As a result, they felt like they were constantly playing catch-up, and their financial planning was always a puzzle with too many unpredictable pieces.

In a landmark decision in 2024, TechNova made the strategic shift. Instead of continuing the cycle of purchasing hardware, they adopted a computer hardware and server leasing model. They signed a straightforward OpEx agreement with a rental provider, and in place of a massive upfront payment, they began paying a fixed monthly rental. The results were compelling. The company’s upfront outlay for 100 new laptops dropped from ₹3,200,000 to zero, with only a refundable deposit required. Their annual depreciation of around ₹6–7 lakh was completely eliminated, and maintenance costs of ₹1.5 lakh were included in their predictable monthly rental fee of ₹1,10,000. Additionally, the burden of asset disposal was transferred to the vendor. Consequently, after accounting for depreciation and downtime, TechNova saved a remarkable 35–40% over three years.

Financial Agility with The Rental Advantage

One of the most compelling aspects of the OpEx model is the unparalleled financial agility it provides. By eliminating the need for large upfront capital expenditures, cash is freed up for more productive and impactful business activities. Instead of being tied up in hardware, these funds can be reinvested into growth initiatives, research and development, or expanding your team. This strategic reallocation of resources can significantly accelerate a company’s growth trajectory.

Furthermore, The Rental Advantage offers a level of financial predictability that is crucial for effective long-term planning. With a fixed monthly payment, your expenses are clear and transparent. You can forecast your IT budget with precision, without worrying about unpredictable repair costs or unexpected hardware failures. This financial clarity allows for better resource allocation and ensures that your company’s finances remain stable and predictable. This is a crucial benefit for any business, regardless of size, as it enables a stronger foundation for strategic growth.

The Operational Gains of The Rental Advantage

Beyond the financial benefits, the OpEx model offers significant operational gains. The constant worry about hardware failure and obsolescence is virtually eliminated. When a device malfunctions, the rental provider is responsible for repair or replacement, ensuring minimal downtime for your employees. This level of support allows your IT staff to shift their focus from reactive problem-solving to proactive, strategic initiatives. They can concentrate on security protocols, network optimization, and implementing new technologies that actually drive the business forward.

This fundamental change in focus allows companies to become more efficient and innovative. By removing the administrative headache of asset management, your team can dedicate its time and expertise to core business functions. This is the essence of The Rental Advantage—it’s not just about saving money; it’s about optimizing your entire operational structure.

Unlocking Scalability and Flexibility

In today’s dynamic business environment, agility is key. The Rental Advantage provides the scalability and flexibility that modern companies need to thrive. Whether you’re a startup experiencing rapid growth or a project-based company with fluctuating hardware needs, the OpEx model allows you to scale up or down effortlessly. When a new project requires additional devices, you can simply rent them. Similarly, when demand lessens, you can return the excess equipment without being stuck with idle assets. This adaptable approach ensures that you only pay for what you need, when you need it. This flexibility is a powerful tool for navigating an uncertain market and adapting quickly to changing demands, giving you a competitive edge.

Comprehensive Support with The Rental Advantage

Another cornerstone of the OpEx model is the comprehensive support that comes with it. Unlike purchased equipment, where you often have to deal with multiple vendors for repairs and support, IT rental services typically include all maintenance and technical assistance. When a device malfunctions, the rental provider handles the repair or replacement, ensuring minimal downtime for your team. This streamlined support system reduces stress and allows your employees to stay productive, with the peace of mind that expert help is always just a call away. This full-service approach is a major benefit that often gets overlooked in initial cost comparisons, but it provides significant value in the long run.

Mitigating Risk and Ensuring Business Continuity

The Rental Advantage also serves as a powerful risk mitigation tool. When you own hardware, you bear all the risks associated with it, from theft and damage to technological obsolescence. If a large number of devices fail or become outdated at once, it can create a major financial and operational crisis. By renting, you transfer these risks to the rental provider. They are responsible for ensuring that your team has working, up-to-date equipment at all times. This continuity is essential for business operations and provides a buffer against unexpected events. It’s an easy way to protect your business from costly disruptions and unplanned expenses.

The Mindset Shift: Overcoming the Ownership Instinct

While the benefits are clear, shifting to an OpEx model requires a change in mindset, particularly for finance teams accustomed to asset ownership. To ease this transition, many companies start with pilot projects. These smaller-scale initiatives allow stakeholders to witness the real-world savings and operational efficiencies firsthand, building confidence in the new model. Another concern is vendor lock-in. To combat this, it’s crucial to select a rental provider with tight service-level agreements (SLAs) that guarantee rapid replacements and high-quality support. Finally, forecasting needs accurately is essential to prevent over-renting or running short on devices. A close partnership with the rental provider can help in creating a flexible plan that aligns with your business cycles.

Common Questions about IT Leasing

How does IT leasing help with business cash flow?

By opting for IT leasing, businesses can significantly improve their cash flow. Instead of a large, one-time payment for hardware, you spread the cost into manageable, predictable monthly expenses. This frees up working capital that can be used for more impactful business activities, such as marketing, product development, or expansion. The Rental Advantage allows you to preserve cash reserves and invest in growth, rather than tying it up in depreciating assets.

What are the key differences between a CapEx and OpEx approach to IT?

A CapEx approach involves purchasing IT hardware, which is considered a capital investment on your balance sheet. This requires a large upfront cost and comes with the burden of asset depreciation and management. In contrast, an OpEx approach involves renting the same equipment, which is treated as a regular operating expense. This model avoids large initial investments, provides predictable monthly costs, and transfers the responsibilities of maintenance and asset disposal to the rental provider.

Is an IT rental service a good fit for startups?

Yes, an IT rental service is an excellent fit for startups. New businesses often have limited capital and unpredictable growth trajectories. The Rental Advantage allows them to acquire the necessary technology without a significant initial investment, preserving their cash flow for critical early-stage expenses. It also provides the flexibility to easily scale up their hardware as the team grows, without the financial commitment of purchasing new devices every time a new employee is hired.

Where can I find reliable IT equipment rental services in India?

For businesses in India looking for a reliable and flexible IT equipment rental partner, you can discover laptop and IT equipment hire with IndiaRENTALZ. They offer adaptable, cost-effective solutions designed to help you focus on your business goals while they handle your technology needs.

Conclusion

The shift from procurement under CapEx to an OpEx model is more than just a financial maneuver; it is a strategic business choice that provides tangible benefits. Companies like TechNova are a testament to the fact that IT rental pays off by providing better cash flow, agility in scaling operations, freedom from asset depreciation, and hassle-free device management. Ultimately, the choice for modern companies is clear. By embracing IT rental, businesses can focus on growth while the tech experts handle the hardware.

One thought on “Switching from CapEx to OpEx—The Rental Advantage ”

Comments are closed.